When you know your financial numbers you become empowered to make more informed business decisions as a freelance developer.

Figuring out your price point becomes a formula based on your current situation. Knowing your numbers is a super power that will help you survive, grow, and thrive as a freelancer.

Most freelance developers struggle with pricing out projects and knowing how much they should charge. When you waste time on projects that can not pay you enough to cover your expenses you are leaving yourself in a bad spot.

It is hard to survive as a freelancer when you don’t get your pricing right.

When you know your number you are powerful

- Understanding your expenses informs your current situation

- Know when you can leave your 9-5 to go full time freelance

- Price structure is easier when you know your current needs

- Make better decisions about the projects that you take on

- Create space for time off from your work

By the time you are done reading this you will know exactly how much you need to charge your clients so that you can keep going as a freelancer.

Quick Note

I created a Notion & Google Sheets template and accompanying mini-course to help you through this process. You can still follow this article, the product simplifies and speeds up the process!

Good or bad, knowing is powerful

It is not too difficult to calculate out your current financial situation. Most people avoid doing this because they “think” that the situation is bad. It might be, but knowing the exact numbers behind your situation is useful as you move forward. It will inform the solution.

How do we calculate this number?

You can use many different tools to calculate this number. Pen and paper or spreadsheets are the easiest. For this example, I am going to use Notion as it provides a powerful way to not only calculate your number but also suggest rates you should charge.

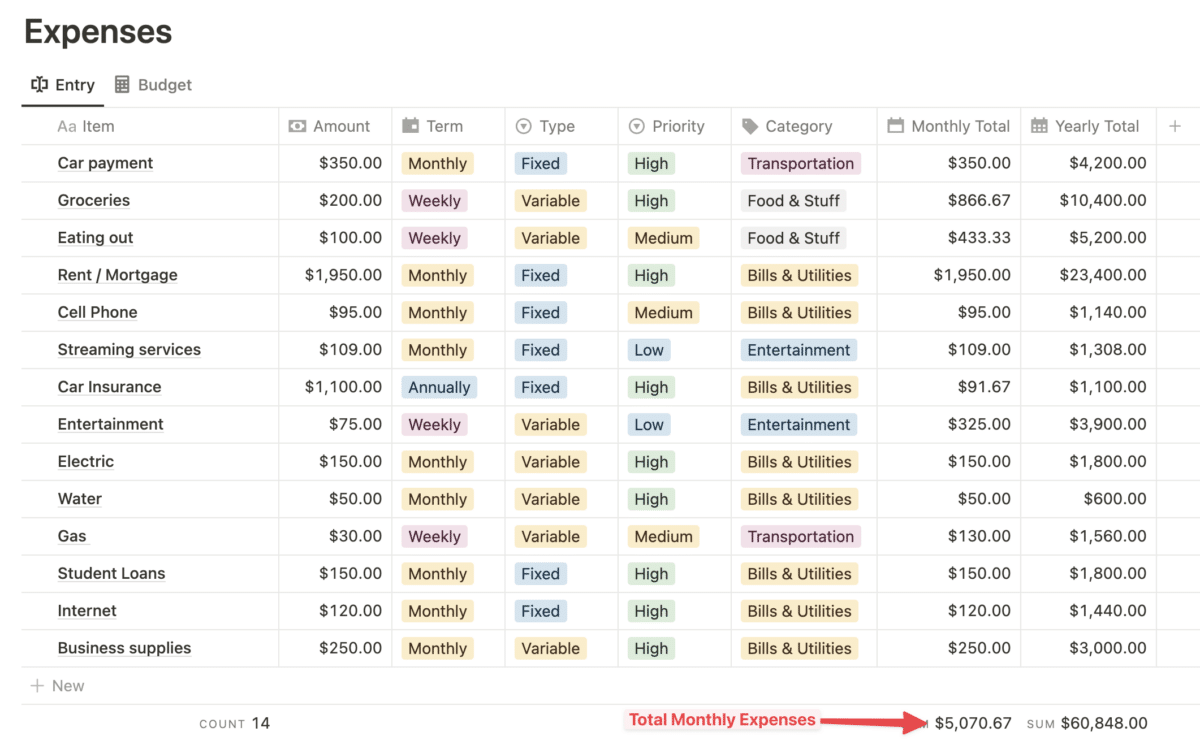

Step 1: Gather information

The first thing we need to do is collect all of our expenses. The easiest way to do this is to gather your credit card and bank statements from the past few months and use them to get the numbers. We do not need to be 100% exact here; it is ok to ballpark a few things, especially around variable expenses.

Include as many items as you can think of, and be honest with yourself about your spending. If you go to Starbucks every morning for a coffee, include that! We need to know the real situation here.

For each item, be sure to include the frequency, amount, and priority. Priority can be a simple “low, medium, high” scale. We will use this later when it comes to adjusting our numbers so don’t worry about it just yet.

Once you have everything identified, you can add up all of the monthly expenses. Congratulations! You now know your bottom line bare minimum number that you need to reach each month.

We are going to use this number and combine it with some information from step 2 to create your ideal rates for hourly, daily, weekly, small, and large projects!

Step 2: Capacity + Buffer + Multipliers

Understanding our expenses is only part of the equation. We are working towards creating a business that fits our ideal life, not a JOB for ourselves.

It is time to think about the amount of time we have to work IN our business. How many billable hours a week can we dedicate?

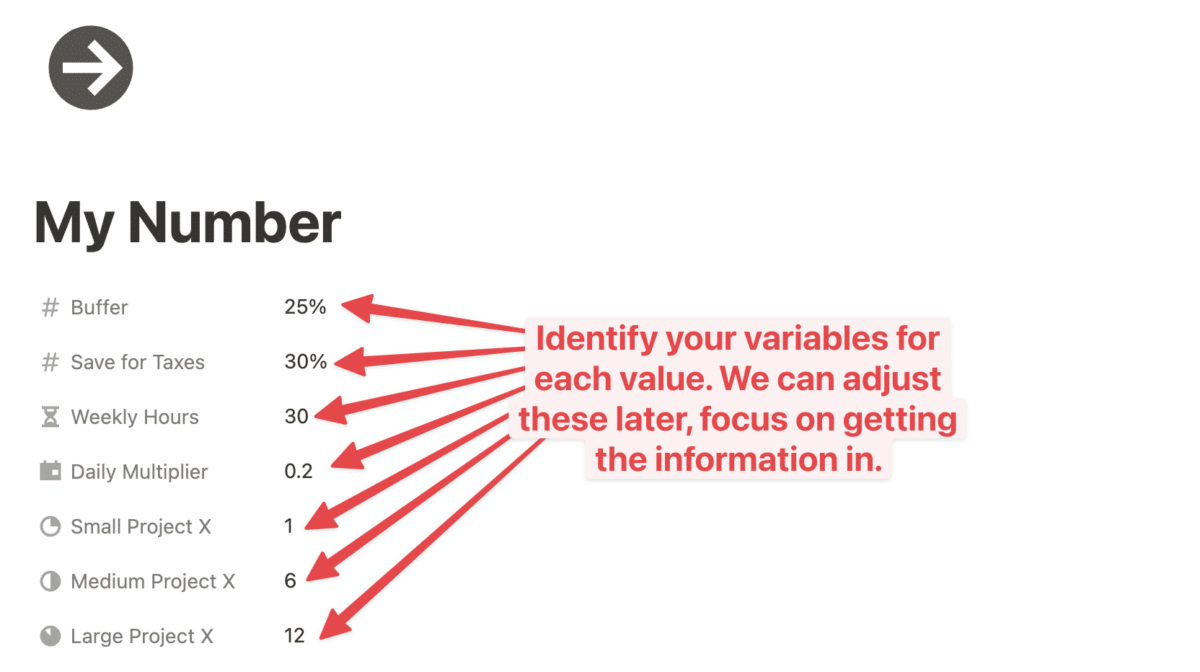

Here are the numbers that we want to figure out:

- Buffer – If you are just starting, this number might be zero. That is OK. But eventually, you will want to make more money than you are spending each month so that you can scale your business. This buffer can help you cover expenses when times are slow or if you get sick.

- Taxes – Your tax rate is something you should know. Talk with an accountant if you are not sure how to calculate this. I would recommend that you set aside 30% for taxes, but your situation may be different so feel free to adjust that number.

- Weekly Hours – How many hours per week do you want to work and bill for? Everyone’s tolerance for work is different and if you are just setting out on your freelance journey, you may be more willing to work more hours. Be sure to set aside some time each week to work ON your business.

- Daily Multiplier – This is more advanced but helpful to use. Basically, how many days per week do you want to work? The multiplier is the percentage of a 7-day week that each of your work days is a portion of. For example, if you plan to work 5 days a week, your multiplier is 0.2. If you planned to work 7 days a week, your multiplier is 0.14285.

- Small Project – Figure out the ideal number of weeks a “small project” would entail. Don’t think about it too much; pick a number we can always adjust later.

- Medium Project – Figure out the ideal number of weeks a “medium project” would entail. Don’t think about it too much; pick a number we can always adjust later

- Large Project – Figure out the ideal number of weeks a “large project” would entail. Don’t think about it too much; pick a number we can always adjust later

We are going to use these numbers to calculate our ideal rates.

Step 3: Calculate

For those using my Notion/Google Sheets template, you can skip this step, as it does all the math for you!

Get the template and mini course here!

Alright, it is math time!

We will use our Monthly Expense Number and the Numbers from Step 2 to calculate our Bare Minimum Monthly Income and our hourly, daily, weekly, and project rates.

Here are the exact formulas for each one:

Bare Minimum Monthly Income

Monthly Expenses = All of your expenses added up for the month

Taxes = [Tax %] × [Monthly Expenses]

Buffer = [Buffer %] × [Monthly Expenses]

Now add all three numbers up, and you have your monthly bare minimum.

We can then take this and also create our Yearly Bare Minimum by multiplying the Monthly Bare Minimum by 12.

You should now have 2 numbers that we are going to use for a lot of the remaining calculations:

- Monthly Bare Minimum

- Yearly Bare Minimum

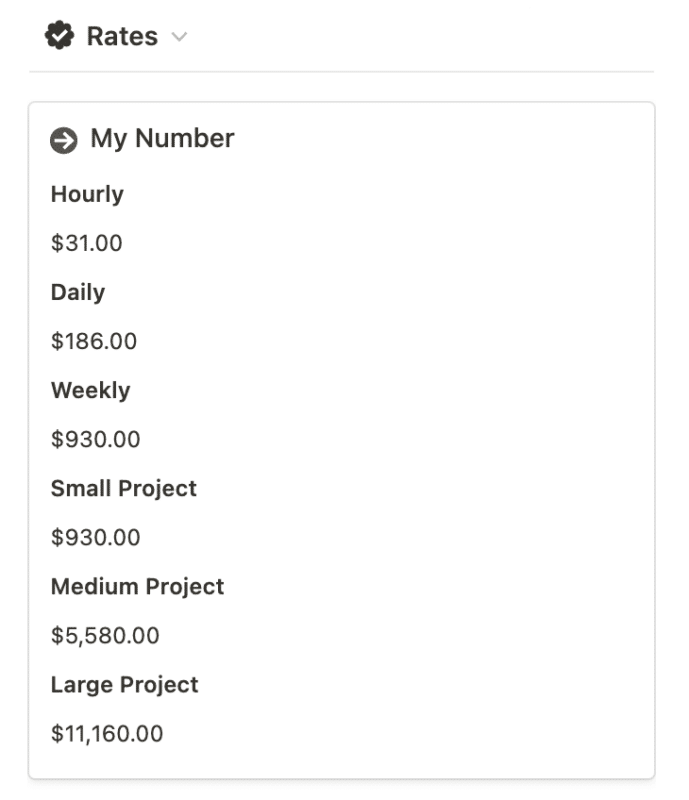

Suggested Weekly Rate

For this, we take our yearly bare minimum and divide by 52 (number of weeks in a year). This will give us the minimum that we need to make each week or if we did a project based on a weekly rate, then we now know the least we should accept.

Weekly Rate = [Yearly Bare Minimum] / 52

Suggested Daily Rate

For this, we take our weekly rate and multiply it by our daily multiplier.

Suggested Daily Rate = [Weekly Rate] × [Daily Multiplier]

Suggested Hourly Rate

For this, we take our Weekly Rate and divide it by the Weekly Hours.

Suggested Hourly Rate = [Weekly Rate] / [Weekly Hours]

Suggested Small Project Rate

Take your Weekly Rate and multiply it by the number of weeks in a Small Project for you.

Suggested Small Project Rate = [Weekly Rate] × [Small Project Multiplier]

Suggested Medium Project Rate

Take your weekly rate and multiply it by the number of weeks in a medium project for you.

Suggested Medium Project Rate = [Weekly Rate] × [Medium Project Multiplier]

Suggested Large Project Rate

Take your weekly rate and multiply it by the number of weeks in a large project for you.

Suggested Large Project Rate = [Weekly Rate] × [Large Project Multiplier]

Step 4: Review

Ok! Now that we have our numbers, it is time to review. This is where you need to look deep inside yourself and bring out the realist. Some questions to help you go through your review:

- Can I reasonably make this amount of money each month?

- How long will it take me to get there? (make a guess)

- Do I have other income sources?

Your gut is probably giving you a feeling one way or another right now. Does the monthly bare minimum seem possible, or is it making you feel queasy?

If you are feeling energized by these numbers (knowing is powerful), then get going! You know what you need to do.

If these numbers make you feel a little queasy, it is time to adjust. Don’t worry; there is always a way!

Step 5: Adjust

Ok, we know the numbers, and they are not what we were hoping for. The monthly minimum feels too far out of reach, and the hourly rate needed to get there is not something we feel we can reasonably charge at this point in our career.

This is not the time to give up. It is time to think about our situation with a critical eye.

There are 3 areas that we can adjust:

- Expenses: Review your expenses. Those items that are low priority might need to be cut for a few months as you figure things out. Would you rather eat out less or keep working at your 9-5?

- Our capacity (weekly hours): Increasing the number of hours you work in the short term could help you create a more manageable hourly rate. Look for opportunities in the future to increase the rate so that you can create more balance. When I started, I worked many 60-hour weeks, which was not sustainable for long, but it helped me get things off the ground.

- Income: Do you have a partner that has an income stream? Could you work a part-time job for a little bit to help make ends meet?

Go through your expenses and adjust your capacity until you feel comfortable with these numbers. Once you are feeling more comfortable, it is time to take action.

How to use these numbers as a freelancer?

You now know the rates you need to charge. This information is incredibly valuable as it helps us say yes to the right projects and market ourselves correctly. We know what we need, and we can strategize on the right way to hit those numbers.

It would be a good practice when you are starting out to check in with these numbers at least once a month. This will help you stay aligned and continue on the right path. Keep adjusting based on your current situation.

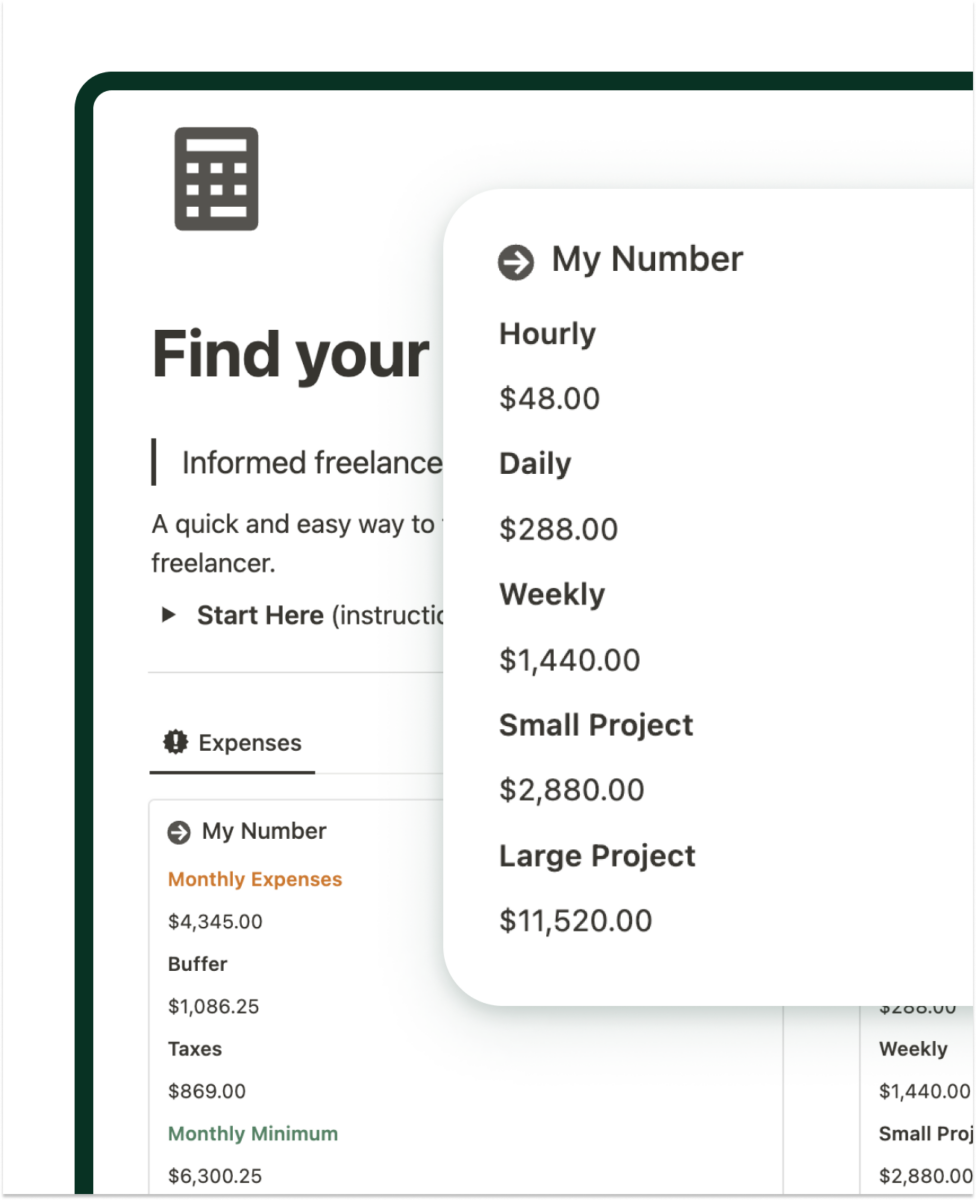

New Product

Get informed, make better $$$ decisions.

Find Your Number

$19

Knowing the numbers behind what you charge is a super-power that will empower you to start freelancing or grow your current service business.